OVERVIEW

A global IT giant hired Turian Labs to understand the financial behavior of internet-savvy users, from the Gen Z to Baby Boomers and beyond, and to help define, develop and launch a fintech product which could change the way in which consumer transactions and peer-to-peer transactions happen in the country.

CLIENT : Global IT giant (one of top 5 IT firms in the world)

TIMELINE : 12 months

OUTCOMES : Validated concept, Behavioral Insights, User Experience framework, Product feature sets, Go-to-market strategy

TEAM : 2 Product Consultants, 3 Design Consultants

PROBLEM

Even after being one of the fastest growing economies in the world and a major political force, India is still way behind other countries in terms of the digitization of its national currency. In the increasingly digitized world, the generations that are getting familiar with the internet find it very difficult to manage their cash, manage and track incoming and outgoing payments, and have spare change. The rising adoption of digital wallets is a major testimony to this problem.

On the other hand, merchants and small businesses in India are still dominated by the use of cash as the primary payment mechanism. This often has led to systemic issues in the country such as corruption, forcing the government to demonetize high-value currency notes in the country in Nov 2016. The effort did not result in a significant decrease in usage of cash, but it did propel a new wave of digital payments (especially mobile-based) spearheaded by private players such as PayTM and government services such as BHIM.

Our client saw this as a tremendous market opportunity, even though the competition was stiff and the digital payments industry was embedded in a web of complex regulatory constraints.

OUTCOMES

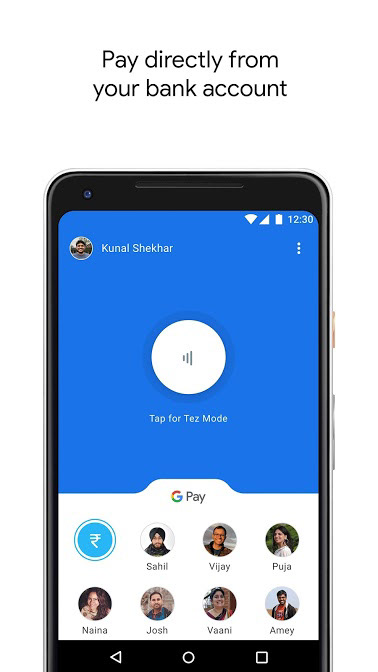

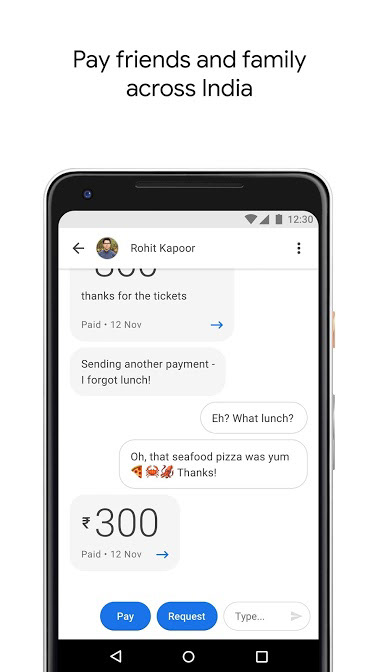

In the span of 10 months, we helped the client build one of the most popular mobile payments products in the country, now being used by more than 16 Million users in 7 languages.

OTHER ACHIEVEMENTS

- 100 Million downloads on Play Store within 15 months of launch

- Average rating of 4.5 with more than 1.5 million reviews

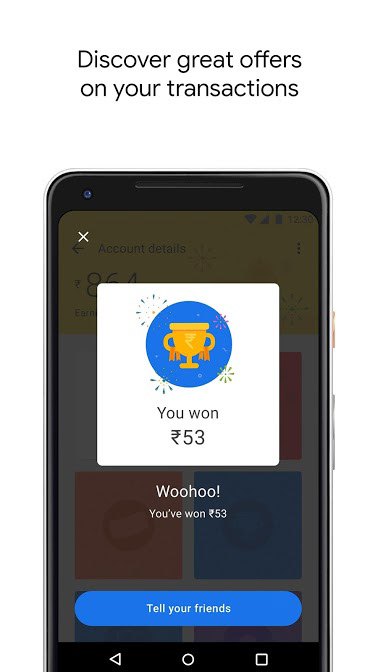

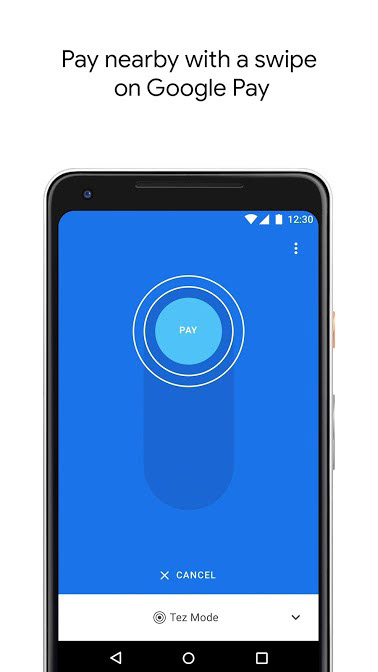

- Unique features such as 'Nearby' payment and digital 'scratch cards'

Through a rigorous process that involved more than 15 design sprints, we constantly refined the hypothesis along with client and developed rich feature sets (some of them the most innovative features of the product), tested them with end-users and stakeholders, developed the user experience framework and the go-to-market strategy.

PROCESS

Through the process of the project, we conducted more than 150 in-depth interviews and more than 300 guerrilla interviews apart from diary studies, on-field observations, contextual inquiry, shadowing, cognitive walkthroughs and more. The flow of the project was based on 2-week design sprints, and our focus shifted from the users to other stakeholders as we refined our hypothesis.

PHASE 1 : EXPLORATORY RESEARCH

In the earliest phases of the project, the goal was to understand and analyze financial behavior and payments from a blank slate, first by mapping the ecosystem and landscape of mobile payments, identifying the various stakeholders involved and their goals and motivations, while also digging deep into consumer behavior and merchant behavior to unearth different mental models and patterns when it comes to payments/managing finances.

KEY RESEARCH GOALS

- Analyze the market landscape and existing players and understand key drivers

- Identify trends and anti-trends

- Understand financial behavior and mental models of Millennials / Gen X consumers when it comes to money

- Identify pain points and needs among small/medium scale merchants in terms of finance/payments

GROWTH OF M-PAYMENTS MARKET

The mobile payments industry at the time of this research was in a high-growth phase, with emerging players competing hard for a slice of the pie and growth efforts being carried out at a high-customer acquisition and retention costs. According to a report by Credit Suisse, the mobile payments industry is set for massive growth, from US $10 Billion in FY18 to US $190 Billion by FY23.

Anticipated growth of mobile payments

A big driver of mobile payments is the growth of m-wallets - a capped storage of money in the cloud that allows users to make on-demand payments from their phones without any additional charges (normally incurred for credit card payments)

Digital payments started to pick up pace with the growth of e-commerce companies followed by emergence of digital wallet companies such as PayTm (backed by Alibaba) to lure the consumers, the digital wallets doled out lucrative offers and cashback to get consumers on board using the payment channel. To expand their reach, the digital wallets started encouraging customers to use them on their phones for offline point of sale (POS) transactions too like at shopping malls, supermarkets, grocery stores, restaurants and gas/petrol stations.

PAYTM

One of the biggest players in the m-payments market is PayTm, which is backed by Alibaba's Ant Financial Services Co. and Warren Buffett's Berkshire Hathaway.

Valued at more than $10 Billion and currently with a registered user base of more than 320 Million users an more than 120 million active users, Paytm was leading the pack in the mobile payments space. Their aggressive marketing efforts and customer acquisition strategy, along with an ever expanding scope of payments (including highway tolls and traffic fines etc.) has managed to grow monumentally year-on-year. It also has 7 Million merchants on its platform (2x the number of banked merchants in India). The company is likely to generate a gross transaction volume of $50 billion in 2019 based on its half-year numbers. This is more than double its GTV in 2018.

To beat an established player such as Paytm - the new solution would have to be innovative and provide a much better user experience.

GOVERNMENT INTERVENTION

On 8 November 2016, the Government of India announced the demonetization of all ₹500 and ₹1000 banknotes of the Mahatma Gandhi Series. It also announced the issuance of new ₹500 and ₹2000 banknotes in exchange for the demonetized banknotes.

This move gave a massive push for digital payment platforms such as Paytm, which became India's first payment app to cross 100 million app downloads in 2017. Merchants started adopting the product since people ran out of cash for the next few weeks. Just during the week of demonetization, the company started seeing a 200 percent increase in downloads and 10 fold increase in the addition of money in the wallet right on the night of demonetization. A year later, the company's merchant base has swollen to 5 million from around 800,000 last year.

UPI - UNIFIED PAYMENTS INTERFACE

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The interface is regulated by the Reserve Bank of India and works by instantly transferring funds between two bank accounts on a mobile platform. UPI uses existing systems, such as Immediate Payment Service (IMPS) and Aadhaar Enabled Payment System (AEPS), to ensure seamless settlement across accounts. It facilitates push (pay) and pull (receive) transactions and even works for over-the-counter or barcode payments, as well as for multiple recurring payments such as utility bills, school fees and other subscriptions. By enabling interoperability between different payment systems, UPI had the potential to revolutionize the digital payments landscape in India.

Introduced as version 1.0 in 2016 and version 2.0 in 2018, UPI is strongly contending with digital wallets to be the primary mechanism for mobile payments in India. Many digital wallet companies, such as Paytm have added UPI as an additional payment mechanism. While the battle between mobile wallets and UPI rages on, the winner will be the platform that offers merchants and users the greatest speed, security, access, user experience and financial sustainability.

The rapid growth of UPI payments

The growth of UPI also disrupted the rapid growth of m-wallets

Here is where things get more interesting - Although, mobile wallet transactions accounts for approximately 10% of overall total digital transactions, revenue wise they only hold 1 % of the total transaction value. Average transaction value on mobile wallet is INR 337 compared to credit cards which is at INR 2,506 in 2017. This was primarily due to a lack of trust in non-bank 3rd party services for larger transactions.

UPI brings in a new value proposition - the convenience of m-wallets with the security layer of a bank transaction, with the digital identities verified by the NPIC (National Payments Corporation of India), which directly links to their unique national identification of the user , the Aadhaar number.

TRENDS AND ANTI-TRENDS

After going through several reports on the financial industry landscape and analyzing consumer/business trends, we arrived at several trends which point at a potential opportunities for change and anti-trends which point against it. This helped us get a macro perspective on the future outlook of mobile payments, helping us form key hypothesis.

IDENTIFYING CONSUMER ARCHETYPES AND GOALS

One of the biggest wins and breakthroughs during this project was identifying consumer archetypes by conducting ethnographic research with users from different demographic and socio-economic segments, to understand their underlying mental models, needs and goals when it comes to finances/payments. Arriving at the archetypes presented with a key anchor for further inquiry and hypothesis generation, since our research could now be directed towards specific directions aimed at catering to/changing some of these mental models in the context we were operating.

IDENTIFYING MERCHANT NEEDS

To identify the primary goals and needs of small scale merchants, we conducted ethnographic research and contextual inquiry across various cities in the country, with merchants at different scale of operations, different kinds of products being sold, and different customer segments. This helped us gain a lot of insights into their implicit needs and pain points.

KEY HYPOTHESIS

Based on the exploratory research conducted with consumers and merchants, we arrived at key hypothesis to be taken ahead for generative research. Some of them were:

1. Tracers are most in need of financial help, since the trackers already have ways to control their finances and ad hocs don't really care much

2. Managing better relationships with customers to improve sales is an area where merchants will be ready to use technological solutions

3. Providing contextual help and reducing the time to payment is a major implicit need, both for users and merchants

4. Peer to peer payments could be structured and a tracking mechanism for that could be helpful

5. Users tend to use digital wallets primarily due to variable rewards such as offers and rewards, which is carried forward from other services they use (Facebook/Instagram/Snapchat)

6. An integration of payment services (one stop shop for all financial payments) was an implicit need for consumers

7. Offline and online payments need to be integrated on a single platform for better customer experience

PHASE 2 - GENERATIVE RESEARCH

RESEARCH GOALS

With generative research, our primary goals were to validate / invalidate and build upon the hypothesis generated from primary research. We decided to go with Tracers as our focus consumer segment since they were potential customers for any financial product which could keep them in control without having to spend too much time/effort.

RESEARCH METHOD

We worked in design sprints of 2 weeks each, testing one hypothesis after another in no particular order but informing each hypothesis with insights from the previous one.

OUTCOMES

After 4 months of iterative research, we arrived at some of the key high level features that would go into the product, as well as the primary user flow of the product. Some of the insights were :

PHASE 3 - EVALUATIVE RESEARCH

RESEARCH GOALS

During the evaluative research stage, we wanted to iteratively design the final prototype that would go into production and then launch. For this, we used evaluative methods such as cognitive walkthroughs, task analysis and scenario analysis. We would start each sprint with a prototype and iteratively improve upon it after receiving the feedback from users.

RESEARCH METHODS

OUTCOMES